http://globaleconomicanalysis.blogspot.com/2008/07/tms-truer-money-supply.html

M Prime

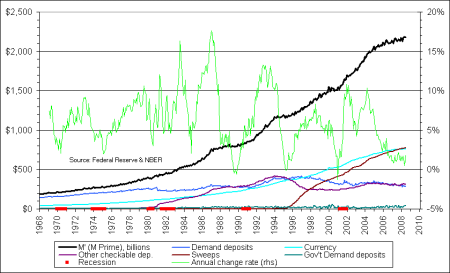

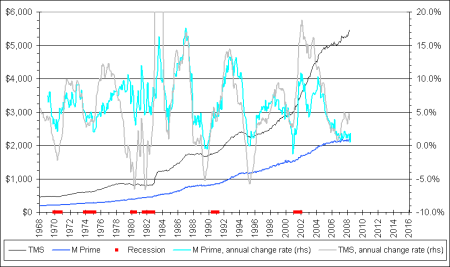

Using Shostak’s definition and with much charting help from Bart at Now and Futures, I came up with M Prime (M’), arguably what TMS is supposed to be. For more details on the origin of M’, please see Money Supply and Recessions.

M Prime 1968 To Present

M’ dips below 2.5% or so are a strong signal of recession.

M Prime vs. TMS

As for measuring inflation or deflation, I do not think any of them will suffice for the simple reason that credit marked to market is plunging and that is the way things need to be looked at. Unfortunately, there is no accurate measure of the plunge in credit because financial institutions are not marking credit to market. Instead much credit is still in SIVs and/or hidden in Level 3 (marked to fantasy) assets.

… That is on top of the distortion I mentioned earlier in that M3 and MZM are expanding because credit lines are being tapped and parked in money market funds.

Judging from collapsing real estate, people walking away from homes, risk aversion sinking in, and banks unwillingness to lend, together with the idea that credit that should be marked to market isn’t, I believe we are in deflation, right here right now. Those focused on M3 or energy and food prices are truly missing the boat. Trillions of dollars of destruction in housing wealth (with much more coming) and another trillion markdown in bank credit coming (on top of what we have already seen) are far more important and far more representative of the state of affairs than is M3, or any other monetary aggregate for that matter.

Is Big Inflation Coming?

…a perfect 15 out of 15 conditions experienced in the great depression are happening today as discussed in Humpty Dumpty On Inflation.

Of course Humpty Dumpty can and does pretend that deflation is specifically about money supply, totally ignoring credit. And those same Humpty Dumpties were amazed by the collapse in commodities and were crushed shorting treasuries because they did not see this coming.

Tags: M prime, M', mike shedlock, mish, Money Supply, versus TMS

Leave a comment